Chiba Bank and LAC Collaborate to Implement AI-Based Fraud Detection Solution in Response to Financial Crimes

15 NOV 2023 | Press

LAC Co., Ltd. (Headquarters in Chiyoda-ku, Tokyo; President and CEO: Itsuro Nishimoto) and Chiba Bank, Ltd. (Headquarters in Chuo-ku, Chiba City, Chiba Prefecture; President: Tsutomu Yonemoto) have entered into an agreement to deploy an artificial intelligence (AI) based fraud detection solution, "AI Zero Fraud", targeting financial crimes such as special fraud schemes, including those that defraud elderly people of their cash cards. Development and implementation of the system is started in November 2023, with full operational deployment planned for 2024.

In recent years, the methods used in special fraud have become increasingly sophisticated. The total loss from such fraud in 2022 was approximately 37 billion yen*1, a persistently high level that shows an upward trend. In addition, fraudulent Internet banking transactions have reached an unprecedented pace, totaling about 3 billion yen*2 in the first half of 2023. The number of fraudulent accounts used by criminals to hold funds from these special frauds and illegal Internet banking transfers has also surged*3, posing a significant threat to the financial sector in Japan.

As part of its strategy to combat specialized fraud and fraudulent accounts, Chiba Bank is committed to improving the detection of suspicious transactions. The bank will use LAC's AI-driven solution, developed by the Financial Crime Control Center (FC3), which analyzes and evaluates the risk of transactions based on the characteristics of criminal activities. The effectiveness of "AI Zero Fraud" was validated through a Proof of Concept (PoC) experiment, which demonstrated high accuracy in detecting fraudulent transactions and accounts in specific fraud cases, leading to an agreement to implement the system.

LAC aims to enhance its fraud detection capabilities by providing AI Zero Fraud to support Chiba Bank's efforts to combat special fraud and manage fraudulent accounts.

AI Zero Fraud: The Fraud Detection Solution

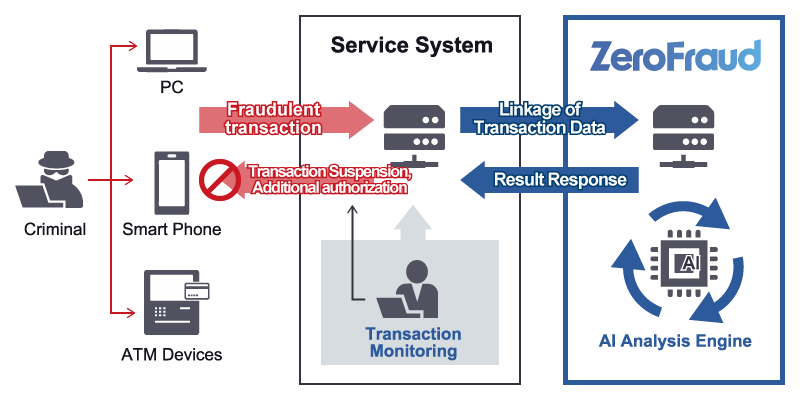

AI Zero Fraud is an innovative solution that uses artificial intelligence (AI) to analyze the transaction behavior of financial service users and detect financial crimes with high accuracy. It assists financial service providers in their efforts to prevent losses from financial crimes such as fraudulent Internet banking transactions and specialized ATM-based frauds*4. It also provides the ability to detect and identify fraudulent accounts used to transfer illicit funds acquired by criminals.

*4 Techniques where criminals deceive individuals for their cash cards and illicitly use ATMs for withdrawals, such as deposit and savings fraud and cash card theft.

AI enables more flexible and accurate detection than traditional methods

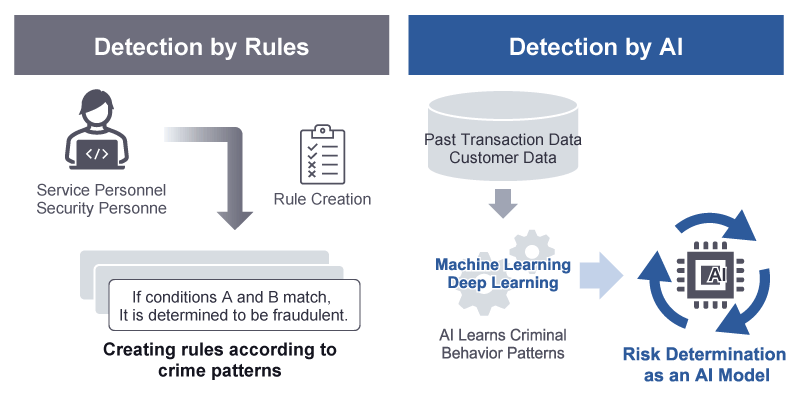

Traditional fraud detection systems typically use rules to detect specific user behaviors and flag transactions as suspicious if they match certain predefined criteria during a fraudulent activity. In contrast, AI-based detection mechanisms involve AI learning the characteristics of banking transactions and analyzing transaction behavior to detect suspected fraud. While rule-based systems provide clarity in detection due to their specific, human-defined conditions, they struggle with complex scenarios. AI systems that have learned transaction characteristics can analyze more nuanced aspects, enabling highly accurate detection of increasingly sophisticated financial crime methods.

Additional Information

AI Fraud Detection Service: AI Zero Fraud (Japanese)

About Chiba Bank, Ltd.

https://www.chibabank.co.jp/english/

Chiba Bank is a leading regional bank with its primary business base in Chiba. As of March 2023, it has a strong network of 181 domestic branches and 6 international locations, making it one of the top regional banks in terms of assets and profitability. The Chiba Bank Group, which consists of 17 companies, offers a wide range of services including securities, asset management, research, consulting, leasing, venture capital, credit cards, business outsourcing, employment services, credit guarantee, debt management, and regional trade, to meet the diverse needs of local customers.

About LAC Co., Ltd.

https://www.lac.co.jp/english/

LAC, a leader in cybersecurity and systems integration, leverages its experience and innovative technology to provide services that address various societal and business challenges. Since its inception, LAC has been involved in development of foundational systems for Japan's financial and manufacturing sectors. In recent years, it has expanded its offerings to include modern IT services suitable for the DX era, such as AI, cloud solutions, and telework. Since launching Japan's first information security service in 1995, LAC has remained at the forefront of cybersecurity, operating the largest security monitoring center JSOC, Cyber Emergency Center, vulnerability diagnostics, penetration testing, and IoT security, making it a leading company in the information security field.

* LAC and the LAC logo are registered trademarks of LAC Co., Ltd. in Japan, and other countries.

* Other company names, organization names, product names, etc., mentioned herein are registered trademarks or trademarks of their respective owners.

* The information contained in this press release is current as of the date of publication and is subject to change without notice.